Evacuations from High-Risk Locations Call +44 (0)1202 308810 or Contact Us →

Saudi Arabia: Will two global crises stop its war in Yemen?

27 Apr 2020

After a failed attempt to establish a ceasefire in the beginning of April, Saudi Arabia and the Houthi officials have been engaged in talks to end hostilities and focus their resources on combatting the Covid-19 pandemic, which might overwhelm the war-torn country.The war is now reaching its sixth year and is looking increasingly unwinnable and costly for the Saudis. With Houthi forces maintaining a strong hold on northern Yemen and the capital Sanaa, neither of the factions are able to achieve a definitive victory. The kingdom has also been severely affected by the virus, which has caused both a contraction of the global economy and a dramatic fall in oil prices. With over 80 percent of Saudi Arabia’s GDP reliant on oil revenue, a prolonged crisis has the potential to cripple the Saudi economy.

Key Points

- After a failed attempt to establish a ceasefire in the beginning of April, Saudi Arabia and the Houthi officials have been engaged in talks to end hostilities and focus their resources on combatting the Covid-19 pandemic, which might overwhelm the war-torn country.

- The war is now reaching its sixth year and is looking increasingly unwinnable and costly for the Saudis. With Houthi forces maintaining a strong hold on northern Yemen and the capital Sanaa, neither of the factions are able to achieve a definitive victory.

- The kingdom has also been severely affected by the virus, which has caused both a contraction of the global economy and a dramatic fall in oil prices. With over 80 percent of Saudi Arabia’s GDP reliant on oil revenue, a prolonged crisis has the potential to cripple the Saudi economy.

- While the initiation of a peace process has been a priority for years, the Covid-19 pandemic and the consequent economic crisis could provide the necessary momentum for the warring factions to reach a sustainable ceasefire, which would allow both Saudi Arabia and Yemen to focus on domestic priorities.

Signs of a rapprochement

On 9 April, the Saudi-led coalition fighting in Yemen officially announced the start of a unilateral 14 day-long ceasefire. The plan entailed a complete suspension of military operations and echoed the plea by UN Secretary General Antonio Guterres for a global ceasefire that would allow to focus resources on tackling the COVID-19 pandemic.

Much like during all previous attempts to secure a mutual ceasefire, hopes for a Houthi reciprocation were swiftly frustrated by their condemnation of the plan. Deemed a political manoeuvre rather than a measure dictated by a humanitarian imperative, the ceasefire was rejected because it maintained the blockade on Yemen, a virtual embargo on all goods, including international aid. Rejecting the Saudi initiative, Houthis representatives directly reached out to the UN special envoy to submit their version of a comprehensive peace plan, demonstrating their intention to join negotiations as a legitimate state actor.

While fighting resumed in the past two weeks after the announcement of the ceasefire, indirect talks between the factions have also been conducted since. This suggests a clear commitment from all fronts to a peace process, despite the clear disagreements on its format, terms and outcomes. These consultations seem to have been fruitful, with the UN Special Envoy in Yemen expressing hope of a nation-wide ceasefire agreement in the near future during his Security Council briefing on 16 April.

Backroom talks between the Saudi and the Houthis have been ongoing for months but have also corresponded to a significant intensification in hostilities, most likely an attempt by both sides to gain leverage at the negotiating table. The Houthis continue to maintain a strong hold on power over the northern part of the country, while also growing bolder in their attacks against the Saudi kingdom. Riyadh, on the other hand, has been struggling to retaliate effectively and has also seen its coalition gradually collapse, with the UAE scaling back their commitment late last year.

The initiation of a credible peace process has been a central part of the Saudi strategy, particularly after the partial withdrawal of the UAE. However, the economic impact of the current Covid-19 pandemic, which has caused a dramatic fall in oil prices and slashed Saudi Arabia’s main source of revenue, is likely to have instilled a new sense of urgency to disengage from Yemen to prioritize domestic policymaking.

The Saudi crown will face difficulties in justifying the commitment to its military engagement in Yemen with the country now engaged in an international battle for oil market supremacy, while also under an indefinite lockdown ahead of the most important Muslim celebrations of the year. To simply withdraw, however, would constitute an admission of defeat against the Houthis and by extension Iran, Saudi Arabia’s regional nemesis. On the other hand, a peace process built on preventing a COVID-19 outbreak in a country already suffering from a humanitarian crisis could represent the necessary narrative and framework for Saudi disengagement.

A double-edged economic crisis

Saudi Arabia, now counting over 10,000 active Covid-19 cases, is among the worst affected countries in the Middle East, only surpassed by its regional rival Iran. While the kingdom was extremely proactive in implementing lockdown measures, halting international flights and banning religious pilgrimages, it is now struggling to find a solution to the devastating socio-economic effects of the pandemic.

Together with the shock caused by the interruption of business operations and the loss of revenue from the tourist industry, particularly ahead of the yearly Hajj pilgrimage, the contraction of the global economy has dramatically decreased oil demands, causing the prices to plummet to unprecedented levels.

The oil markets were already experiencing considerable instability, due to a price war initiated by Saudi Arabia to retaliate against Russia and its refusal to comply with a production cut earlier in March. Their decision to flood an already stagnating market with cheap crude caused the prices to drop, hitting their lowest point since 2016.

While Saudi Arabia is generally well equipped to withstand oil market fluctuations thanks to its large stockpiles, the timing of this latest standoff could not have been worse, as it caused a supply shock when the virus was already driving the demand down. Even as an agreement among Russia and the OPEC members on a 10 million bpd cut was reached on 9 April, it was insufficient to stop the prices from free-falling, with the value of futures in the US market eventually reaching negative figures for the first time in history.

As the world’s biggest oil exporter, Riyadh relies heavily on its oil revenue to finance government spending and, anticipating an oversaturation of the market, it has already resorted to stringent austerity measures domestically. While its considerable financial reserves should allow the kingdom to temporarily sustain the fiscal stimulus packages planned for the private and health sectors, a prolonged oil crisis combined with the pandemic has the potential to cripple the Saudi economy, which is paying the price of its lack of diversification.

While the Saudi population has so far expressed relative satisfaction with the government’s handling of the Covid-19 pandemic, much of the country’s economy depends on public spending and, therefore, oil revenue. The longer the crisis continues, the more unsustainable the large-scale subsidies will become. Facing a double-edged economic crisis, it is highly likely that Riyadh will look to disengage from a conflict that has been syphoning enormous financial resources out of the kingdom in order to focus on domestic priorities.

From strategic priority to military standstill

The Saudi intervention in the war in 2015 was officially motivated by a desire to fight on behalf the UN-backed Hadi government, which was ousted by Houthi forces as they occupied Sanaa the year prior. However, as with many conflicts, especially in the Middle East, it had profound strategic and religious undertones. The Iranian support to the Shiite Houthi forces, both ideological and military, meant that, if left unchecked, the conflict could have resulted in the Saudi borders and territory being directly threatened by a proxy of its biggest rival.

Of potentially even greater strategic importance is the geographical dimension of such an alliance, which could allow Iran to exert control over two of the most important maritime choke points in the world, the Strait of Hormuz and Bab el-Mandab. As evidenced by last year’s attacks against tanker vessels allegedly perpetrated by the Iranian Revolutionary Guard. The ability to disrupt oil trade represents an incredibly powerful weapon against Saudi Arabia, whose GDP is made up of 80 percent in oil export revenue. Control over both straits, combined with the ability to directly target Saudi domestic infrastructure, would dramatically increase Tehran’s leverage over Riyadh.

The effort to neutralize Houthi forces has, thus far, been unsuccessful and has instead locked Saudi Arabia into a drawn-out war despite its clear military superiority. In the past year, the Saudi-led coalition has achieved virtually zero military gains and has instead lost one of its main allies, the Houthi forces have made significant advances in northern Yemen and increased their ability to directly attack Saudi territory.

The strike against two Saudi Aramco-owned Abqaiq and Khurai oil processing facilities that took place on 14 September 2019, while unlikely to have been launched from Yemen, represented a turning point for the start of real negotiation between Riyadh and Sanaa. By managing to shut down a portion of Saudi oil production, albeit for a short time, right during the preparation for the prestigious Saudi Aramco’s IPO, the attack dramatically highlighted the kingdom’s strategic vulnerabilities and the growing cost of the war.

In the meantime, Saudi Arabia had suffered the loss of its main ally in the conflict, as the UAE had announced its intention to withdraw from Yemen during the summer of 2019. The UAE’s disengagement from Aden forced Saudi Arabia to stretch its military resources to fight on both fronts, while also triggering a period of intense instability and infighting in the south, which culminated in an attempted coup d’état by secessionist forces in August last year. While a power-sharing agreement has been reached since, the UN-backed Hadi government appears extremely weak and doubts have been raised over its ability to govern over the south without international support.

The fragility of the peace in the south was highlighted on Saturday, 26 April, as the secessionist forces, led by the Southern Transitional Council (STC), announced their intention to break the truce and take control over the coastal provinces and key ports, including Aden. The plan was swiftly condemned by both Saudi Arabia and the UAE, the main backer of the STC, as it fundamentally undermined the cohesion of the southern front and weaken the Hadi government in a crucial moment of negotiation with the Houthis.

After over five years of conflict, Houthi militias maintain a strong hold on power over northern Yemen and the Saudi-led coalition is unlikely to achieve its objective of liberating the north and restoring the Hadi government as the legitimate ruler of a unified Yemen. By engaging in talks and negotiations, Saudi Arabia might be changing its approach towards the Houthis, attempting to find a successful compromise that would both distance them from Iran, prevent further attack on its energy infrastructure, and scale down its commitment to a costly military endeavour.

A way out?

Confronted with a devastating collapse of the oil market, the economic shock created by the pandemic, and a military impasse in Yemen, Saudi Arabia will have to adopt a new strategic outlook both domestically and internationally. With Covid-19 threatening its public health and economic revenue, Riyadh is looking to focus its resources on more domestically oriented policies aimed at mitigating the damage of plummeting oil prices and a months-long halt in business operations.

The repeated talks with the Houthi forces would suggest an effort by the Saudi government to reach a compromise that will prevent further attacks on its territory and infrastructure, allowing the kingdom to disengage from a conflict causing it to continuously bleed out resources. On the other hand, while the Houthi are keenly aware of their increased leverage in the current situation, their willingness to engage with Saudi Arabia, especially through the UN Special Envoy, would suggest a mutual desire for a sustainable peace process.

The Houthis will likely take advantage of their upper hand in the conflict to impose an incredibly high cost for Saudi’s exit from the war, chief among them the legitimisation of their authority over the northern territories and the complete removal of the blockade.

Their insistence on a bilateral rapprochement, moreover, is a clear indication of their intention to shut out the internationally recognised Hadi government from all negotiations on the future of the country. This would effectively cause Yemen to split into two countries, along similar lines to the pre-unification process in 1990. This would, in turn, lead to Saudi Arabia sharing a border with a nation closely aligned with Iran, defeating its primary objective in the war.

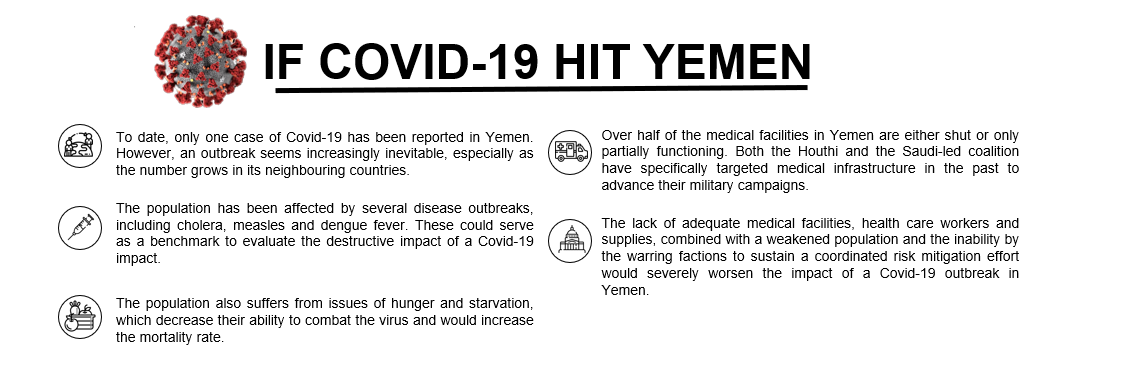

However, the Covid-19 pandemic could also offer a common ground for rapprochement and the agreement of a nationwide ceasefire. The Houthis are undoubtedly aware that an outbreak of the virus in a country, already suffering from a humanitarian crisis and lacking adequate medical infrastructure even to sustain its existing needs, would be devastating. Thus, while the virus could play a role in allowing the Houthis to achieve their strategic objective and effectively win the war, it could also decimate its population.

However, the Covid-19 pandemic could also offer a common ground for rapprochement and the agreement of a nationwide ceasefire. The Houthis are undoubtedly aware that an outbreak of the virus in a country, already suffering from a humanitarian crisis and lacking adequate medical infrastructure even to sustain its existing needs, would be devastating. Thus, while the virus could play a role in allowing the Houthis to achieve their strategic objective and effectively win the war, it could also decimate its population.

This would be an opportunity for Saudi Arabia to normalise its relationship with the Houthis and distance them from their Iranian ally, as the kingdom could decide to play an extensive role in providing medical assistance to Yemen, while the country inevitably faces the virus. This would allow Riyadh to disengage from an extremely expensive conflict, protect its critical infrastructure, and establish a peace process grounded in humanitarian objectives rather than a strategic defeat. Ultimately, however, the longevity of any effort towards peacebuilding will likely be determined in the post-Covid era.